Current stock price formula

An option price of 226 requires an expenditure of 226. In the example shown the formula in cell D5 copied down is.

Amibroker Knowledge Base Quickafl Facts Stock Data Facts Exponential

GOOGLEFINANCE AAPLpriceINDEX GOOGLEFINANCE AAPLclose0101 today 22-1 As you can see by copying and pasting the formula.

. To illustrate how to calculate stock value using the dividend growth model formula if a stock had a current dividend price of 056 and a growth rate of 1300 and your required rate of return. To retrieve the daily close price for Apple AAPL for the month of January 2021 the formula in cell B4 is. The formula is available in-cell and is used by passing the stock ticker symbol into the formula if you enter the symbol manually it must be a string.

Select stock names from the dataset and choose the Stocks option from the Data option. What is the current stock priceTable of. Current Price of Stock.

Stock Price Dividends Paid Div Expected Price P1 1 Expected Return R Proving this calculation with our example information above we have. My formula looks like this. Common Stock can be calculated using the formula given below Common Stock Total Equity Preferred Stock Additional Paid-in Capital Retained Earnings Treasury Stock Common.

With the cells still selected go to the Data tab and then click Stocks. STOCKHISTORY D5TODAY 201 Then drag the Fill Handle icon to cell E7 and then you will notice that the range of. If Excel finds a match between the text in the cells and our online sources it will.

Then enter the following formula in the cell E5. So an option price of 038 would involve an outlay of 038 x 100 38 for one contract. GOOGLEFINANCE GOOG Step 6 Note.

To get the latest close price of a stock with a formula you can use the STOCKHISTORY function. The net present value of the stocks price increase one hundred years from now is only 5. Stock Price 300.

A stock just paid a dividend of 03. In other words we can stay that the Stock Price is calculated as Lets. This calculator calculates the current price of stock using current dividend per share required rate of return stock growth rate values.

The goal is to. STOCKHISTORY AAPL DATE 2021 1 1 DATE 2021 1 31. While its possible to run through typically the calculations its obvious that 100.

Present value of stock dividend per share discount rate - growth rate Or as an equation. Simply select the cells that contain the stock namesticker symbols and navigate to the Data tab in the Excel Ribbon. For a call option the break.

Next click the Stocks button within the Data Types group. Finally if the current stock price is equal to the intrinsic value then we say the stock is fairly priced. In addition to getting stock prices for a date range you can also get the current stock price by including only the ticker symbol as a parameter.

This way the company names will convert to stock names. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding. To create a table go to Insert Table.

Using this is simple and straightforward. Lets now apply the formula for stock valuation in an example. The required rate of return is 146 and the constant growth rate is 73.

Pin On Malaiyurmedia

Technical Analysis Patterns Cheat Sheet For 2022 Chart Patterns Indicator Chart Technical Analysis Stock Chart Patterns Analysis

Finance Investing Accounting And Finance Finance

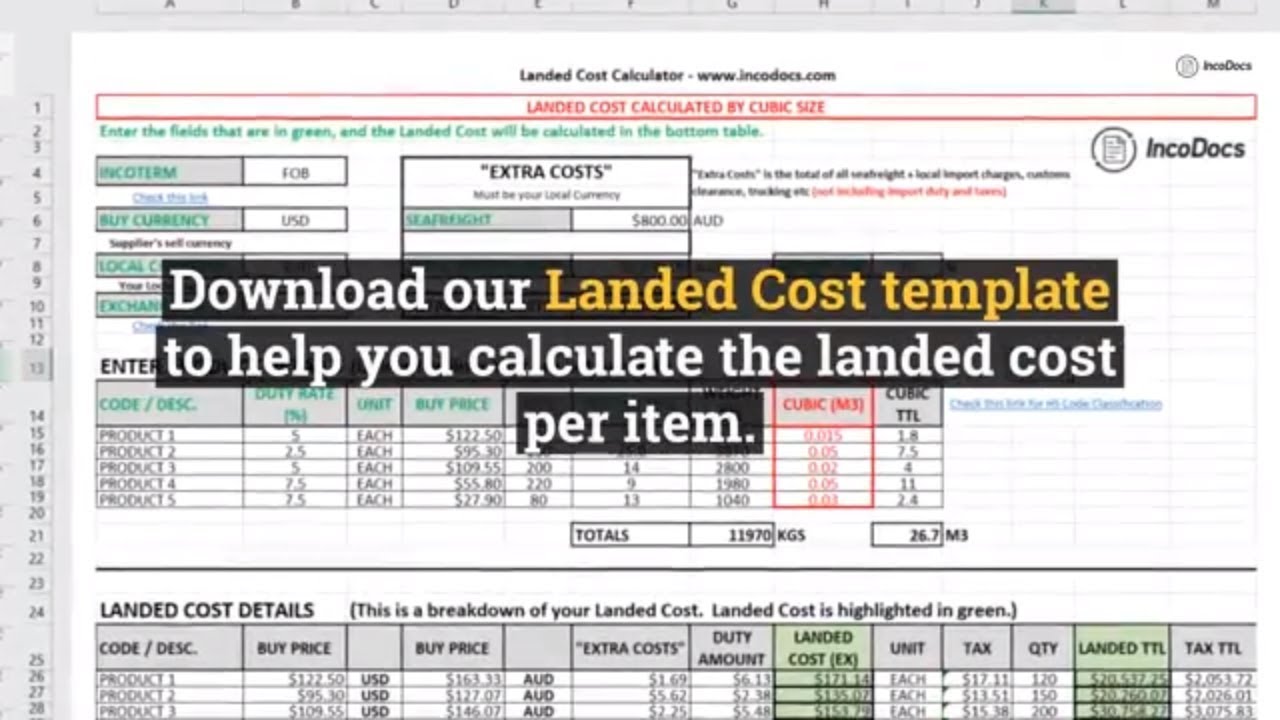

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

How To View Current Stock Prices And Other Quotes In Excel Stock Data Excel Stock Ticker

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Budgeting

Equity Value Formula Calculator Excel Template Enterprise Value Equity Capital Market

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

What Is The Intrinsic Value Formula Try This Online Calculator Getmoneyrich Intrinsic Value Learning Mathematics Fundamental Analysis

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

The Price Earnings Ratio P E Ratio Is The Relationship Between A Company S Stock Price And Earnings Per Share Financial Ratio Investing Cash Flow Statement

Slope Intercept Form Calculator With Steps Why Is Everyone Talking About Slope Intercept For Slope Intercept Form Slope Intercept Math

The Dividend Yield Is An Estimate Of The Dividend Only Return Of A Stock Investment Assuming The Dividend Is Not Rai Money Management Financial Ratio Dividend

Perpetuity In 2022 Economics Lessons Accounting And Finance Finance